The Custom Private Equity Asset Managers PDFs

Wiki Article

The Greatest Guide To Custom Private Equity Asset Managers

(PE): spending in companies that are not openly traded. Approximately $11 (https://www.openstreetmap.org/user/cpequityamtx). There might be a couple of points you do not recognize concerning the industry.

Personal equity companies have a range of investment preferences.

Because the best gravitate toward the bigger deals, the center market is a significantly underserved market. There are extra sellers than there are extremely seasoned and well-positioned finance specialists with extensive customer networks and sources to handle an offer. The returns of private equity are normally seen after a few years.

Everything about Custom Private Equity Asset Managers

Flying below the radar of large multinational firms, most of these tiny firms commonly provide higher-quality customer care and/or specific niche items and services that are not being provided by the large empires (https://www.pageorama.com/?p=cpequityamtx). Such benefits attract the passion of personal equity firms, as they have the insights and wise to exploit such chances and take the business to the following degree

The majority of supervisors at portfolio business are offered equity and incentive compensation frameworks that reward them for hitting their economic targets. Private equity possibilities are often out of reach for individuals that can not spend millions of dollars, but they shouldn't be.

There are laws, such as limitations on the accumulation quantity of cash and on the variety of non-accredited investors. The personal equity service this contact form attracts some of the very best and brightest in business America, consisting of leading entertainers from Ton of money 500 business and elite management consulting companies. Regulation companies can also be recruiting grounds for personal equity employs, as accountancy and lawful skills are required to complete offers, and purchases are extremely demanded. https://issuu.com/cpequityamtx.

The Best Strategy To Use For Custom Private Equity Asset Managers

Another downside is the lack of liquidity; as soon as in a private equity deal, it is difficult to obtain out of or sell. There is an absence of versatility. Personal equity likewise features high charges. With funds under monitoring currently in the trillions, private equity firms have ended up being eye-catching financial investment vehicles for wealthy people and establishments.

Now that access to personal equity is opening up to even more specific capitalists, the untapped potential is coming to be a fact. We'll start with the major arguments for spending in exclusive equity: How and why private equity returns have historically been higher than various other assets on a number of degrees, Exactly how consisting of personal equity in a portfolio influences the risk-return profile, by aiding to diversify against market and cyclical risk, Then, we will certainly detail some crucial considerations and dangers for personal equity investors.

When it concerns introducing a new property into a portfolio, one of the most standard factor to consider is the risk-return account of that possession. Historically, private equity has exhibited returns similar to that of Emerging Market Equities and more than all other traditional property courses. Its fairly reduced volatility paired with its high returns produces a compelling risk-return account.

Custom Private Equity Asset Managers Things To Know Before You Get This

Personal equity fund quartiles have the best range of returns throughout all different possession courses - as you can see listed below. Approach: Inner rate of return (IRR) spreads out computed for funds within vintage years independently and after that balanced out. Typical IRR was calculated bytaking the average of the median IRR for funds within each vintage year.

The result of adding exclusive equity right into a portfolio is - as constantly - reliant on the profile itself. A Pantheon research study from 2015 recommended that consisting of personal equity in a profile of pure public equity can unlock 3.

On the other hand, the very best private equity firms have access to an even larger swimming pool of unknown opportunities that do not deal with the very same scrutiny, as well as the resources to perform due diligence on them and determine which deserve buying (Syndicated Private Equity Opportunities). Spending at the very beginning suggests greater risk, but also for the firms that do succeed, the fund gain from higher returns

Custom Private Equity Asset Managers for Beginners

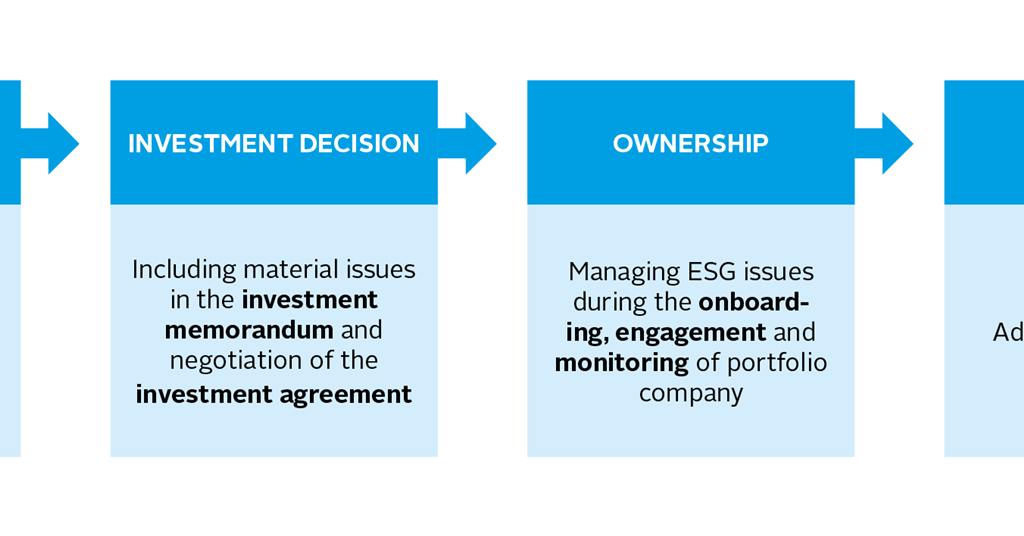

Both public and exclusive equity fund supervisors dedicate to spending a percent of the fund yet there continues to be a well-trodden concern with lining up interests for public equity fund administration: the 'principal-agent trouble'. When a financier (the 'major') hires a public fund supervisor to take control of their funding (as an 'agent') they delegate control to the supervisor while keeping ownership of the possessions.

In the instance of exclusive equity, the General Companion doesn't just earn an administration charge. Personal equity funds additionally mitigate one more kind of principal-agent problem.

A public equity capitalist inevitably desires one point - for the administration to boost the stock price and/or pay out rewards. The financier has little to no control over the choice. We showed above the number of personal equity techniques - specifically bulk buyouts - take control of the running of the firm, ensuring that the long-term value of the company precedes, rising the roi over the life of the fund.

Report this wiki page